additional net investment income tax 2021

In general net investment income for purpose of this tax includes but isnt limited to. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Assume his net earnings from self-employment are US208700.

. Married filing separately 125000. Net investment income for the year. Single or head of household 200000.

The NIIT is broadly speaking a 38 surtax on net investment income. For estates and trusts use undistributed net investment income The amount by which your MAGI exceeds the relevant amount listed above. The alternative minimum tax is calculated by first determining the tentative minimum tax.

For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. What is the NIIT 38 Medicare Surcharge.

Your net investment income which is your investment income minus expenses. Here are the income thresholds that might make investors subject to this additional tax. This 38 surcharge Net Investment Income Tax is certainly more significant than the 09 Additional Medicare Tax both apply to thresholds over 250K married filing jointly and.

That means you could pay up to 37 income tax depending on your federal income tax bracket. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net investment income or 350000 250000 100000 of modified adjusted gross income yielding an NIIT of 100000 3 8 3800. The second tax faced by high-income taxpayersthe net investment income tax NIITis a 38 percent tax on qualifying investment income such as interest dividends capital gains rents royalties and passive income from businesses not subject to the corporate income tax.

Youll owe the 38 tax. For purposes of the NIIT investment income includes but isnt limited to. The threshold amounts are based on your filing status.

Your net investment income is less than your MAGI overage. However if the taxpayer is also subject to the net investment income tax there is an additional 38 tax imposed on those same capital. See more about calculating your net investment income.

Modified adjusted gross income over a certain. Married filing jointly or qualifying widow er 250000. 10 with AGI up to 66000 in 2021 and 68000 in 2022.

MAGI is generally gross income less certain. When you trigger the high-income threshold for the Medicare surtax then you could pay 38 29 Medicare plus 09 surtax on some portions of your income. 20 with AGI up to 43000 in 2021 and 44000 in 2022.

We will discuss very. Youll owe the 38 tax on the lesser amount. The thresholds amounts are 250000 MAGI for married couples filing jointly and 200000 for single individuals.

NII includes among other things taxable interest dividends gains. Income generated by certain types of businessesspecifically limited partnerships. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

In the US short-term capital gains are taxed as ordinary income. It applies only to certain high-income individuals. Your additional tax would be 1140 038 x 30000.

200000 Married filing jointly. 2021 Federal Income Tax Brackets. Theres an additional 38 surtax on net investment income NII that you might have to pay on top of the capital gains tax.

Qualifying widow er with a child 250000. The 2021 minimum tax for married couples filing joint returns and singles is 26 of the first 199900 of alternative minimum taxable income in excess of the exemption amount plus 28 of any additional alternative minimum taxable income. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage.

Single or head of household. The tax is calculated by multiplying the 38 tax rate by the lower of the following two amounts. The NIIT is 38 percent on certain net investment income.

According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-income households see Congressional Research Service The 38 Net Investment Income Tax. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the. If the taxpayer receives a salary from the firm however that income would be subject to the Additional Medicare Tax The Treasury Department has estimated that in 2013 58 percent of S corporation income and 18 percent of partnership income was nonqualifying investment income.

Heads of households can claim a credit for up to 2000 of contributions at a rate. More precisely the NIIT is the lesser of 1 net investment income or 2 the amount by which Modified Adjusted Gross Income MAGI exceeds the threshold amounts. This tax is also known as the net investment income tax NIIT.

Income Tax In Germany For Expat Employees Expatica

What Is Investment Income Definition Types And Tax Treatments

Sc Tells Cbdt To Address Nri Tax Fears In 2021 Mutuals Funds Deferred Tax Investing

Easy Net Investment Income Tax Calculator

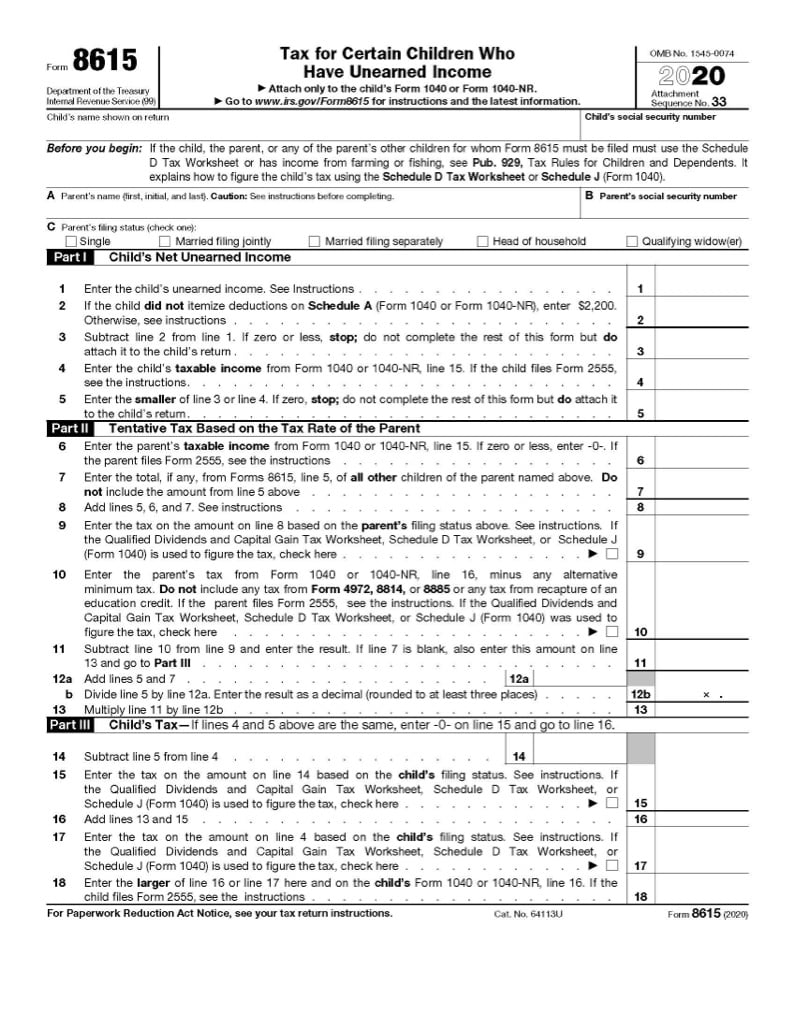

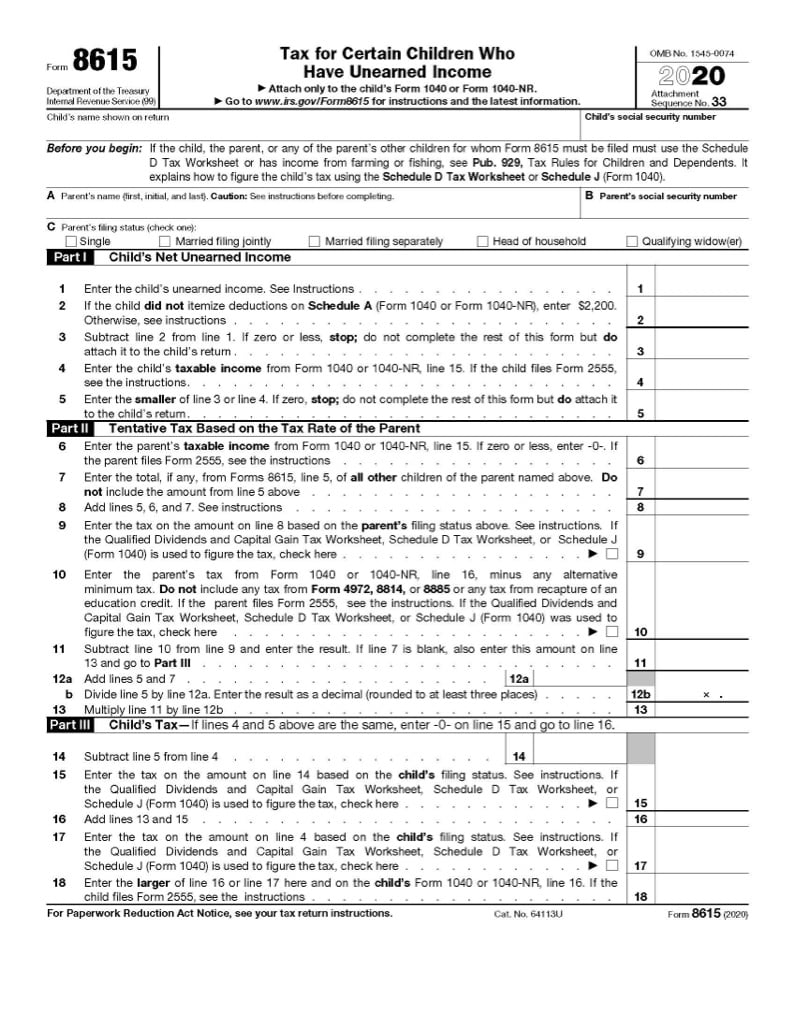

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

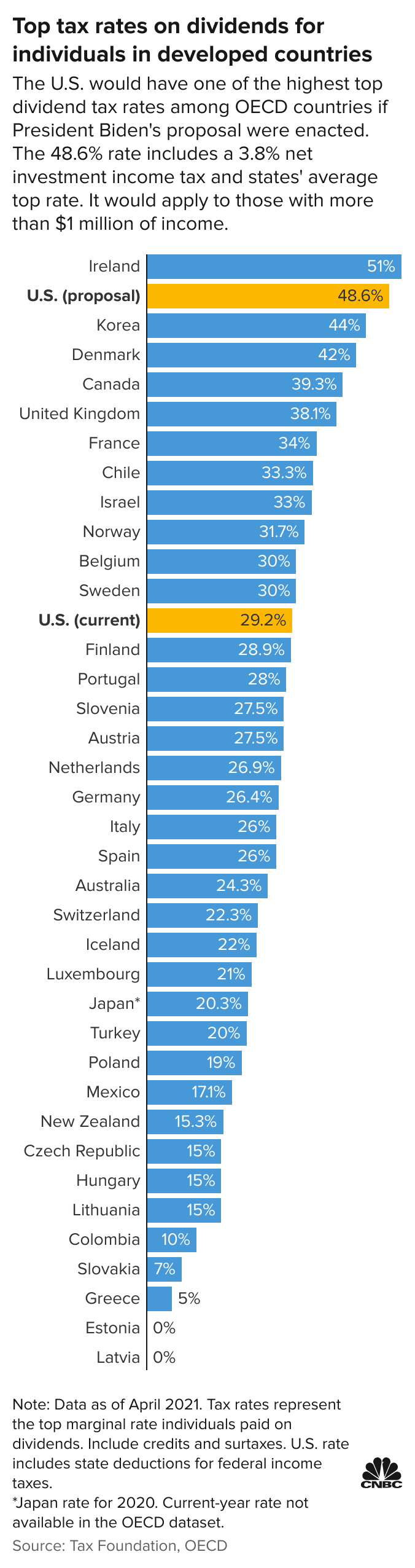

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Gauge Your Tax Bracket To Drive Tax Planning At Year End Putnam Investments

Self Employment Tax Rate Higher Income Investing Freelance Income

Net Investment Meaning Importance And Calculation Scripbox

What Is The The Net Investment Income Tax Niit Forbes Advisor

Like Kind Exchanges Of Real Property Journal Of Accountancy

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

Pin By Andrew Wright On Div Dividend Investors Dividend Income